How Do Mobile Payments Pay Off for Small and Medium Businesses?

As a small business owner, you probably already use mobile for some things: updating your social media pages, checking bank balances, or communicating with customers. And you probably know about the mobile card readers that turn your phone or tablet into a POS (point-of-sale) terminal.

As today’s POS systems become more affordable and easier to use, businesses that have held back due to cost or fear of complication are starting to move forward. In fact, 40 percent of small businesses are already working with a mobile card reader, and with compelling evidence that using one could actually increase the amount customers spend, more companies — including your competitors — will soon join the trend. Read on for more compelling statistics on how going mobile can help your business succeed.

Check out even more resources

Best Ways to Collect Data in Manufacturing

Data analysis is the heart of any well-functioning manufacturing company. Without accurate, real-time data, manufacturing plants are left in the dark about costs, areas that need improvements, quality assurance, employee production, and so many other valuable insights.

Improving Your Manufacturing Workflow With Apps

Have you ever wondered how manufacturing companies like Nvidia, SpaceX, Tesla, Intel, and Nike remain at the forefront of their industries? These companies obsess over optimizing their manufacturing process. To create and maintain a near-flawless workflow…

Wastewater Processing: 8 Tips to Make Your Manufacturing Site More Sustainable

When it comes to wastewater disposal, manufacturers can place a significant strain on municipal water systems. The lack of proper waste management leads to sanitary waste, particularly in metropolitan areas’ water supply.

Connect with an Expert Today.

We’ll help you put together the right solution for your needs.

Text Version

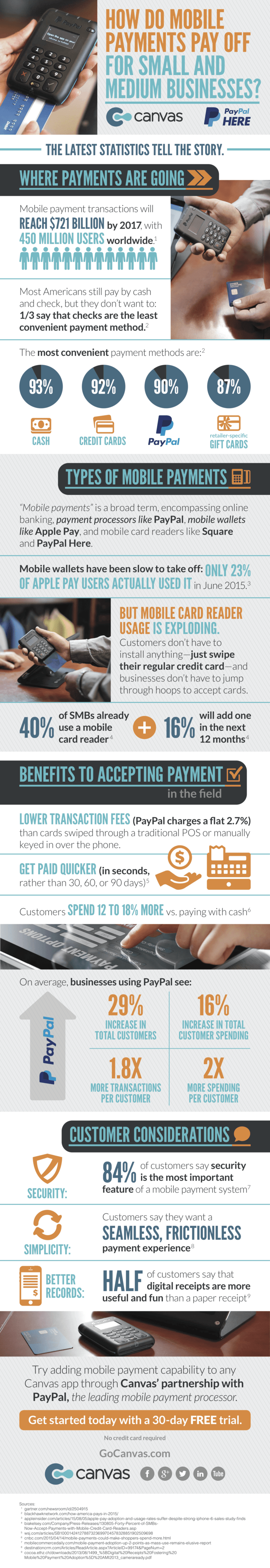

How do mobile payments pay off for small and medium businesses?

The latest statistics tell the story. Where payments are going: Mobile payment transactions will reach $721 Billion by 2017, with 450 Million users worldwide. Most Americans still pay by cash and check, but they don’t want to: 1/3 say that checks are the least convenient payment method.

The most convenient payment methods are: 93% Cash; 92% Credit Cards; 90% PayPal; 87% Gift Cards;

Types of mobile payments: “Mobile payments” is a broad term, encompassing online banking, payment processors like PayPal, mobile wallets like Apple Pay, and mobile card readers like Square and PayPal Here. Mobile wallets have been slow to take off: Only 23% of Apple Pay users actually used it in June 2015. But mobile card reader usage is exploding. Customers don’t have to install anything – just swipe their regular credit card – and businesses don’t have to jump through hoops to accept cards.

40% of SMBs already use a mobile card reader. 16% will add one in the next 12 months.

Benefits to accepting payment: Lower transaction fees (PayPal charges a flat 2.7%) than cards swiped through a traditional POS or manually keyed on over the phone. Get paid quicker (in seconds, rather than 30, 60, or 90 days).

Customers spend 12% to 18% more vs. paying with cash. On average, businesses using PayPal see a 29% increase in total customers; a 16% increase in total customer spending; 1.8X more transactions per customer; 2X more spending per customer.

Customer considerations: Security: 84% of customers say security is the most important feature of a mobile payments system.; Simplicity: Customers say they want a seamless, frictionless payment experience.; Better records: Half of the customers say that digital receipts are more useful and fun than paper receipts.